|

|

Order by Related

- New Release

- Rate

Results in Title For tax 2009

| Taxes stressing you out? Feel better by smacking around our virtual accountant. The more he takes out of your pocket the better you will feel after a good throwdown. .. |

|

| Solve a fun and challenging race car puzzle. Complete the puzzle to win. ..

|

|

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com .. |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income. ..

|

|

| Non-filers of late tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you have delinquent tax returns, don .. |

|

| Tax Brackets Estimator is a tax planning tool. Tax Brackets Estimator displays your tax bracket, i.e. top tax percentage on the last dollar taxable income earned. The software includes tax information for year 2000-2005 and different filing status. ..

|

|

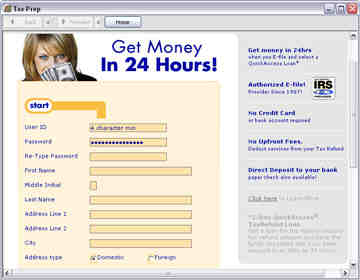

| Online income tax preparation and electronic filing software. Get a refund fast using your computer online. Quick & easy! .. |

|

| This is a very simple application that goes deep and calculates the most tax refunds you are entitled to. Some of the returns you get might be unknown to you. Using this application you see all the refunds that are unique to you. .. |

|

| It is an Indian Income Tax Calculator. Generate Reports: 1) SARAL 2) Computation. .. |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained. .. |

|

Results in Description For tax 2009

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained...

|

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

| TaxBrain Online Tax Software. The quick and smart way to handle your tax return. Best of all, it's convenient, easy-to-use, free to try and guaranteed accurate. TaxBrain Online handles IRS and all state tax filing...

|

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data inf.. |

|

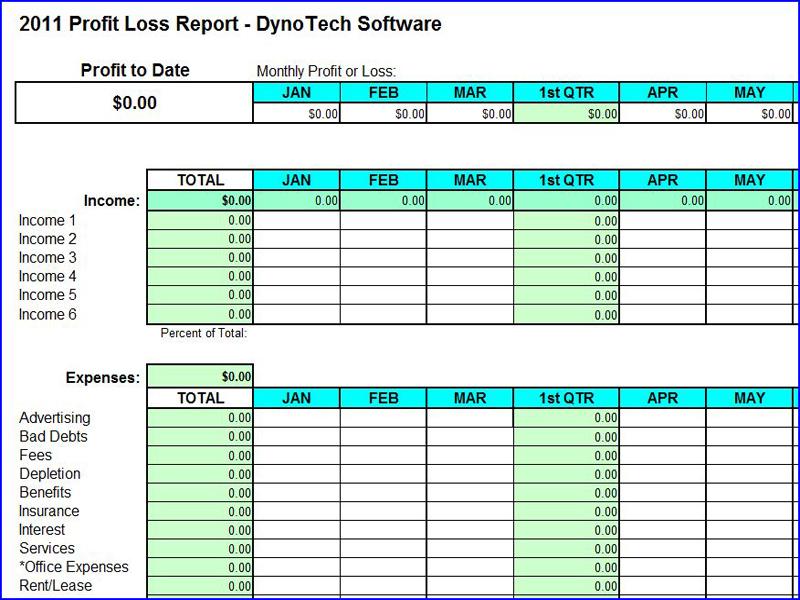

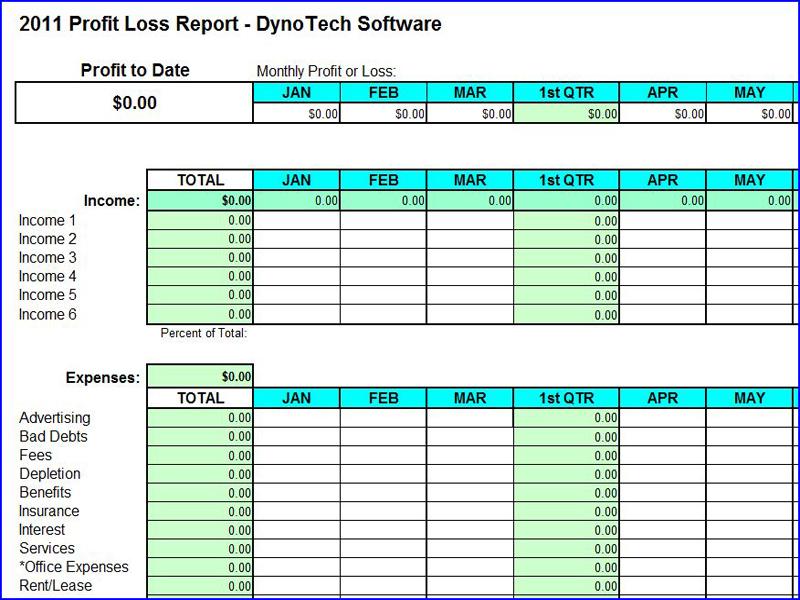

| Award-winning Excel spreadsheet is a simple alternative to accounting software for a small business to track income and expenses. Easier for you and tax preparer when tax time rolls around. Save time, money and tax time headaches. Requires MS Excel...

|

|

| CheatBook (11/2009) - Issue November 2009 - A Cheat-Code Tracker with Hints, Tips, Tricks for several popular PC Action and Adventure Games. 266 PC Games, 55 Walkthroughs for PC and 53 Console Cheats are represented in this new version... |

|

| WhiteSmoke 2009 - Grammar. Spelling. Style. WhiteSmoke 2009 is an all-in-one tool for proofreading and editing your writing. Improve your sentences, vocabulary, and writing style. Spell Checker. Punctuation Checker... |

|

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com.. |

|

| East-Tec Backup 2009 backs up and protects the files and data you care about. East-Tec Backup 2009 is very easy to use and features intuitive wizards, automatic backups, data compression, strong military AES encryption and FTP support... |

|

Results in Tags For tax 2009

| OnePriceTaxes tax software allows you to file your individual federal and state income tax return with the IRS and your state all for the one low price of $19.95. Taxes hurt, filing shouldn't... |

|

| OnePriceTaxes tax software allows you to file your individual federal and state income tax return with the IRS and your state all for the one low price of $19.95. Taxes hurt, filing shouldn't...

|

|

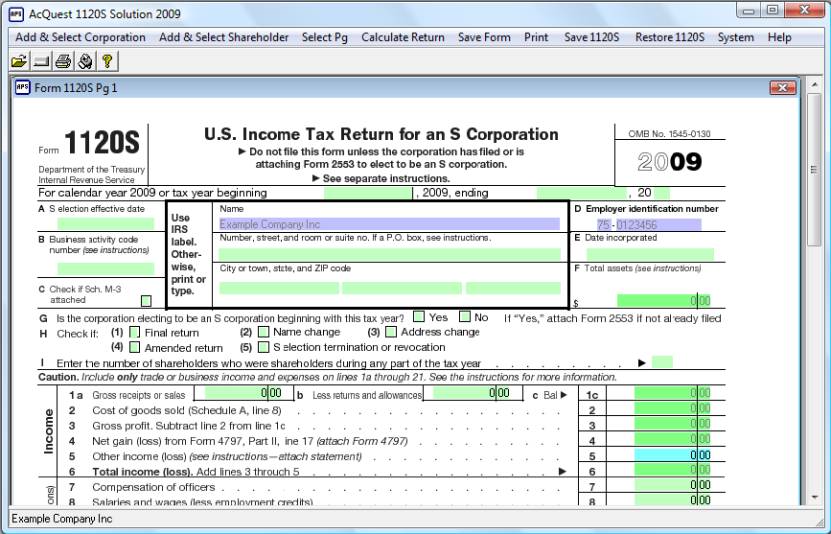

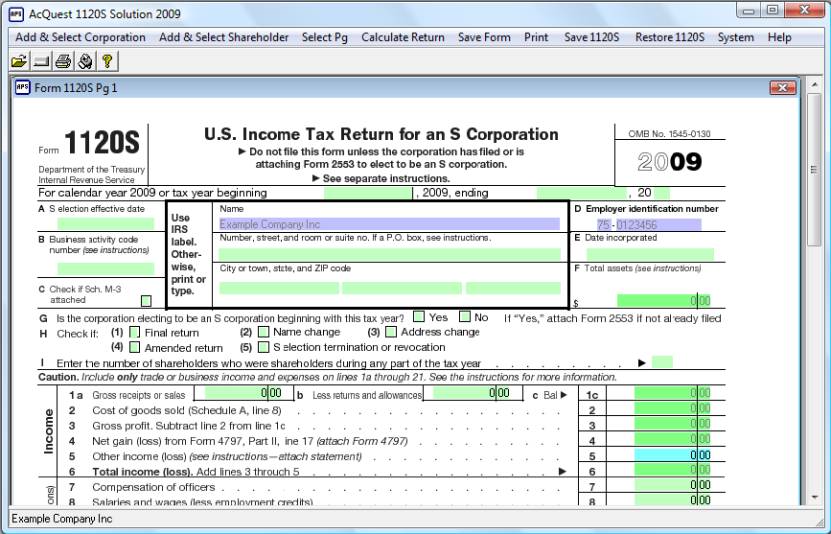

| AcQuest 1120S Solution 2009. Windows 95, 98, ME, XP & Vista. Prepares Form 1120S, U.S. Corporation Income Tax Return for an S Corporation, K-1's, Sch D, 4562, 4797, 8825, & Deprn Schs. With unregistered version, data can be printed but not saved... |

|

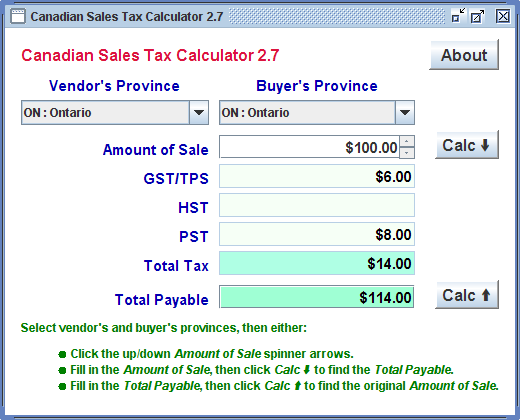

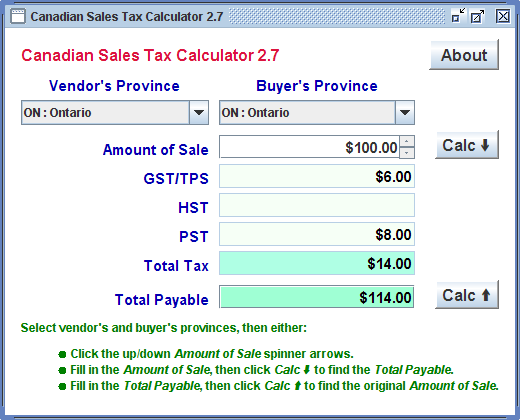

| Calculates Canadian sales taxes: GST HST and PST. Works either as an application or as an Applet that needs to run in JDK 1.3+ capable browser...

|

|

| Tax Brackets Estimator is a tax planning tool. Tax Brackets Estimator displays your tax bracket, i.e. top tax percentage on the last dollar taxable income earned. The software includes tax information for year 2000-2005 and different filing status... |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income...

|

|

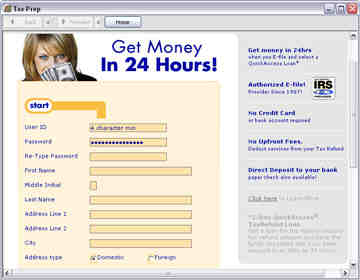

| Online Income Tax preparation and electronic filing software. Get a refund fast using your computer online. Quick & easy!.. |

|

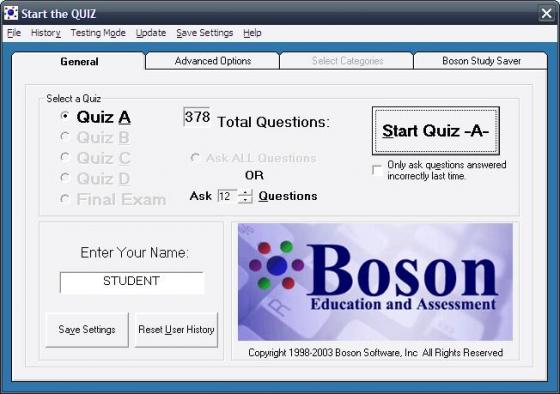

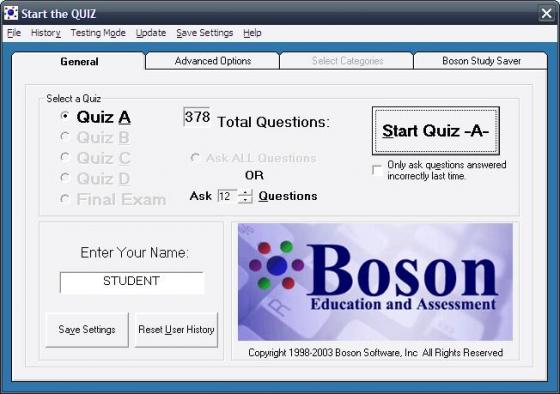

| Tests 2009 is exam and quiz maker that enables educators to easily create quizzes with images, narrations, mathematical formulas to engage learners through the learning process... |

|

| You don't have to be a tax expert to prepare your own taxes with TaxCut from H&R Block. A step-by-step interview identifies new tax breaks you can use, tells you which forms you need, performs the calculations, and checks your return for common errors and potential IRS audit flags. Download now for a FREE trial run to see how TaxCut Deluxe can help you! When you're ready to print or e-file your return, it's easy to order the full version of TaxCut Deluxe and import the work you've already completed! take control of your tax prep with great speed, ease, and accuracy using TaxCut from H&R Block, the #1 rated do-it-yourself tax software* on the market... |

|

| America's #1 efile tax software! Free tax preparation. No rebate gimmicks. Only $24.95 if you choose to efile your federal return and your state is free. You may also choose to receive your refund in as little as 24 hours. All active military personnel can efile their federal & state return for free. We don't offer hidden fees or tricks. We offer safe, affordable & fast tax preparation & efiling... |

|

Related search : ax returntax softwarereturn withonepricetaxes taxfile your,tax return withtax software onepricetaxessolution 20091120s solutionacquest 1120s,acquest 1120s solution1120s solution 20092009 acquest 1120ssolution 2009 acquest,brackets estimatortax brackeOrder by Related

- New Release

- Rate

sales tax rate 2009 -

2009 income tax rates -

2009 federal tax tables -

irs 2009 tax forms -

2009 housing tax credit -

|

|